Serenity Equity™ is a real estate investment company established in 2009.

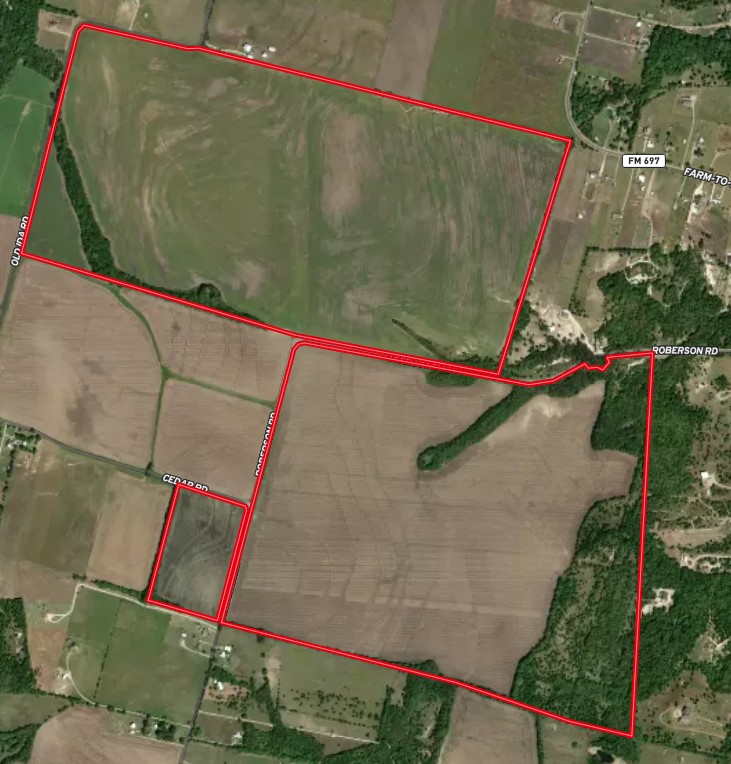

Our real estate portfolio includes undeveloped agricultural tracts as well as commercial real estate through the Dallas-Fort Worth Metroplex and North Texas regions.

Serenity Equity is a dynamic real estate investment firm founded by professionals with a keen eye for identifying emerging markets. With a team of experts from diverse fields such as engineering, technology, real estate, and business management, Serenity Equity brings a unique advantage in analyzing investment opportunities. This blend of expertise has been honed over years of successful collaboration throughout varying market conditions. Our team has a strong track record of achieving significant returns through strategic acquisitions, business ventures, and investments.

Serenity Equity is currently focused on acquiring large agricultural tracts in Dallas-Fort Worth and the North Texas and South Oklahoma regions. With strong financial capabilities, we are positioned for continued growth.

What are we looking to buy?

What are we looking to buy?

Location

-

North TexasPrimarily Grayson County. Additionally: Fannin, Hunt, and Cooke County.

-

South OklahomaMarshall and Bryan County

Land Size

Large tracts over 40 acres, preferably between 100 acres and 300 acres.Price

$1 to $10 millionPreferences

- Tracts should be relatively flat, preferably less than a 3% gradient in the topography

- Farmland preferred, but ranches can be considered if the topography is right

- Preferably no structures (e.g., houses and large barns) on the land

- We understand that there may be some old house where the farmer or tenant lives, but we do not want to pay for extravagant or luxurious homes

- Road frontage is needed, but highway frontage is preferred

- Maintaining an agricultural exemption is a must

- Minimal floodplain, if any

Our Strategy

100% cash transactions.

Streamlined processes with minimal bureaucracy.

- Acquire and hold properties for decades or generations.

- Minimal maintenance while holding the property.

- Potential lease-back to sellers or continued leasing to tenants.

Properties will later be sold to developers, capitalizing on long-term appreciation.

No interest in hunting, fishing, or agricultural/cattle activities.